HCDE Public Pensions: Transparency & Accountability

About TRS

-

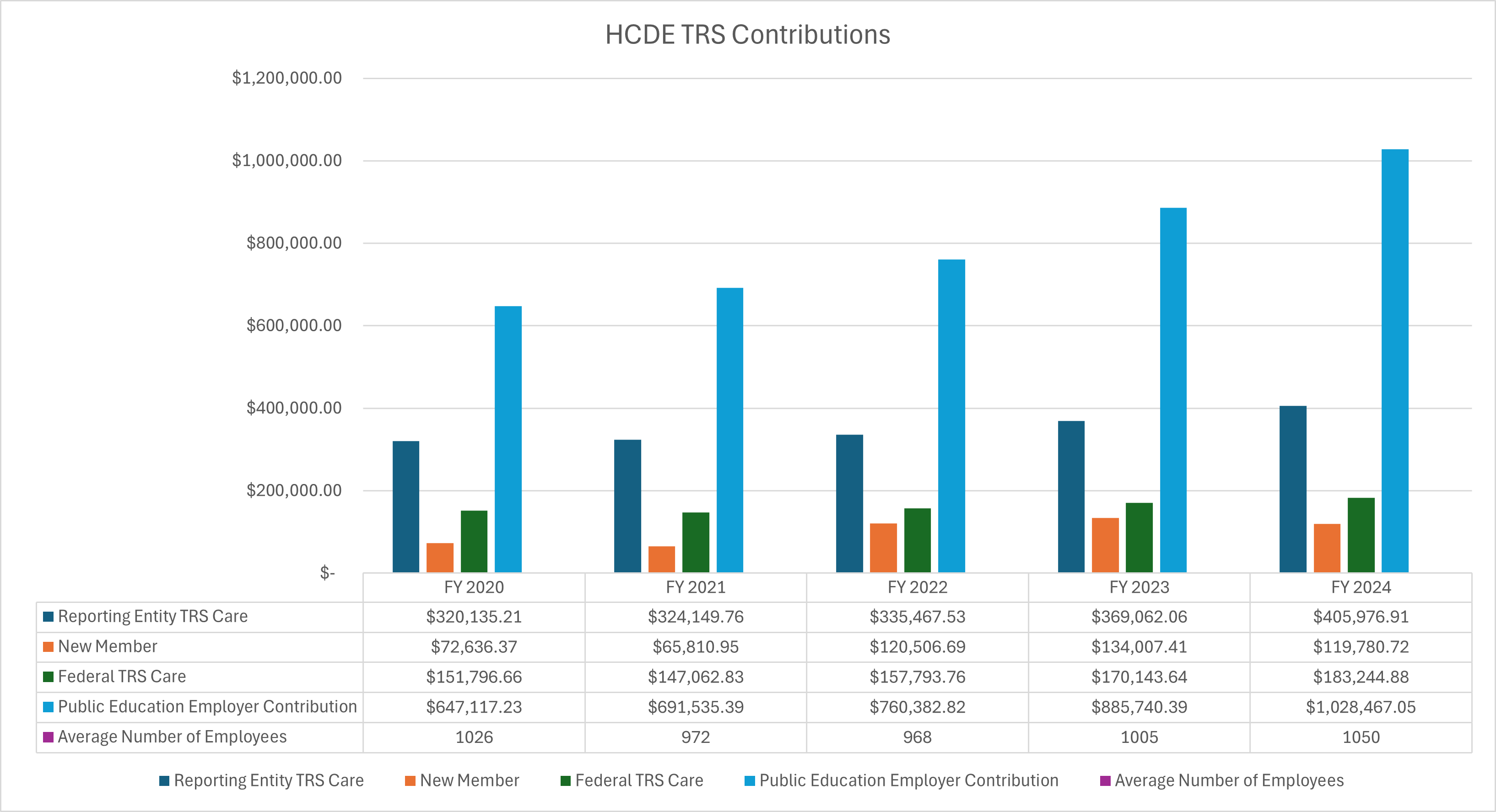

Harris County Department of Education (HCDE) participates in the Teacher Retirement System of Texas (TRS), a statewide, multiple-employer cost-sharing defined benefit pension plan. TRS is governed by state statutes and administered at the state level; the plan assets and pension obligations are collectively shared among all participating entities. As a public education employer in Texas, HCDE provides eligible employees with retirement and related benefits through TRS, in accordance with state law. The Department adheres to the contribution rates and benefit provisions established by the Texas Legislature and administered by TRS.

TRS Highlights

-

-

8.25% Employee

Contribution Rate -

1:1

Matching Ratio

1:1

Matching Ratio

(State to

Employee) -

5 Years Required

for Vesting

Pension Plan Information

-

Service Retirement Eligibility

Service Retirement Eligibility

YEAR JOINED TRS ELIGIBILITY REQUIREMENTS Before September 1, 2007 Age 65 with 5+ years of service creditOR- Any combination of age and service totaling 80

- Have at least 5 years of service credit.

September 1, 2007 - August 31, 2014 Age 65 with 5+ years of service creditOR- At least age 60

- Meet the Rule of 80 (combined age and years of service credit equal at least 80), and

- Have at least 5 years of service credit.

On or after September 1, 2014 Age 65 with 5+ years of service creditOR- At least age 62

- Meet the Rule of 80 (combined age and years of service credit equal at least 80), and

- Have at least 5 years of service credit.

-

Service Credit

TRS service credit is an important part of determining eligibility for TRS benefits including TRS-Care.

Service credit affects the amount of a service or disability retirement benefit you may receive when you retire. In the event of your death as a TRS active member, service credit can also affect benefits paid to your beneficiary.

You establish service credit in two ways:

- Through eligible employment in Texas public education

- By purchasing service credit when eligible

-

Investment Returns

For the twelve-month period ending August 31, 2024, the total portfolio delivered investment returns of 12.83 percent, which is 3.55 percent above the Pension Trust Funds (Fund) benchmark. As a result, the total investment value of the Fund as of August 31 was $209.5 billion, or $22.9 billion more than this time last year, after contributions and benefit payouts.

On a three-year annualized basis, the Fund has returned 3.01 percent, which is 0.90 percent above its benchmark.

Annual rates of return for the five and ten-year periods ending August 31, 2024, were 7.94 percent and 7.24 percent, respectively. Both rates surpassed the Board's adopted long-term assumed rate of return of 7.00 percent.

Investment risks are diversified over a very broad range of market sectors and securities.

TRS' investment strategy is designed to minimize downside risk while capturing upside performance, and it reduces portfolio risk from adverse developments in sectors and issuers experiencing unusual difficulties and offers opportunity to benefit from future markets.

-

Cost of Living Adjustment

A cost-of-living adjustment (COLA) was dependent on Texas voters approving a constitutional amendment (Proposition 9) to authorize the COLA. Voters approved the amendment in the November 2023 election and the COLA will be applied to eligible annuitants' payments beginning with their January 2024 payment due the last business day of the month (Jan. 31).

Contact Us

-

Dr. Jesus J Amezcua, Assistant Superintendent for Business Services

jamezcua@hcde-texas.org

713-696-1371

6300 Irvington Blvd

Houston, Tx 77022

Brenda Del Valle, Executive Assistant to the Assistant Superintendent for Business Services

brenda.delvalle@hcde-texas.org

713-696-8249

6300 Irvington Blvd

Houston, Tx 77022For board inquiries, please contact

Jessica Bermea, Executive Assistant to the Board of Trustees

jbermea@hcde-texas.org

713-696-8246

6300 Irvington Blvd

Houston, Tx 77022

Actuarial Info & Valuation Reports

-

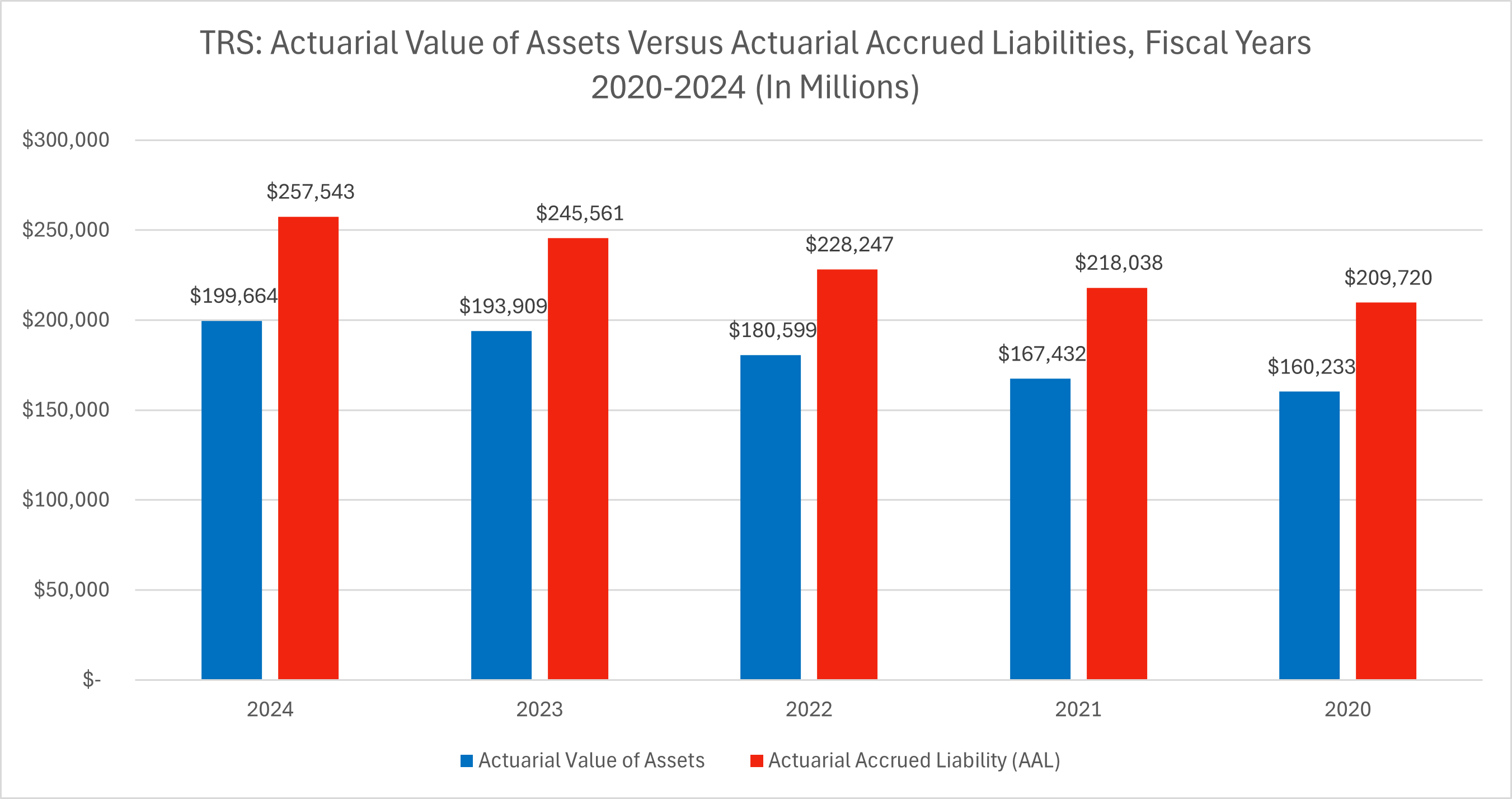

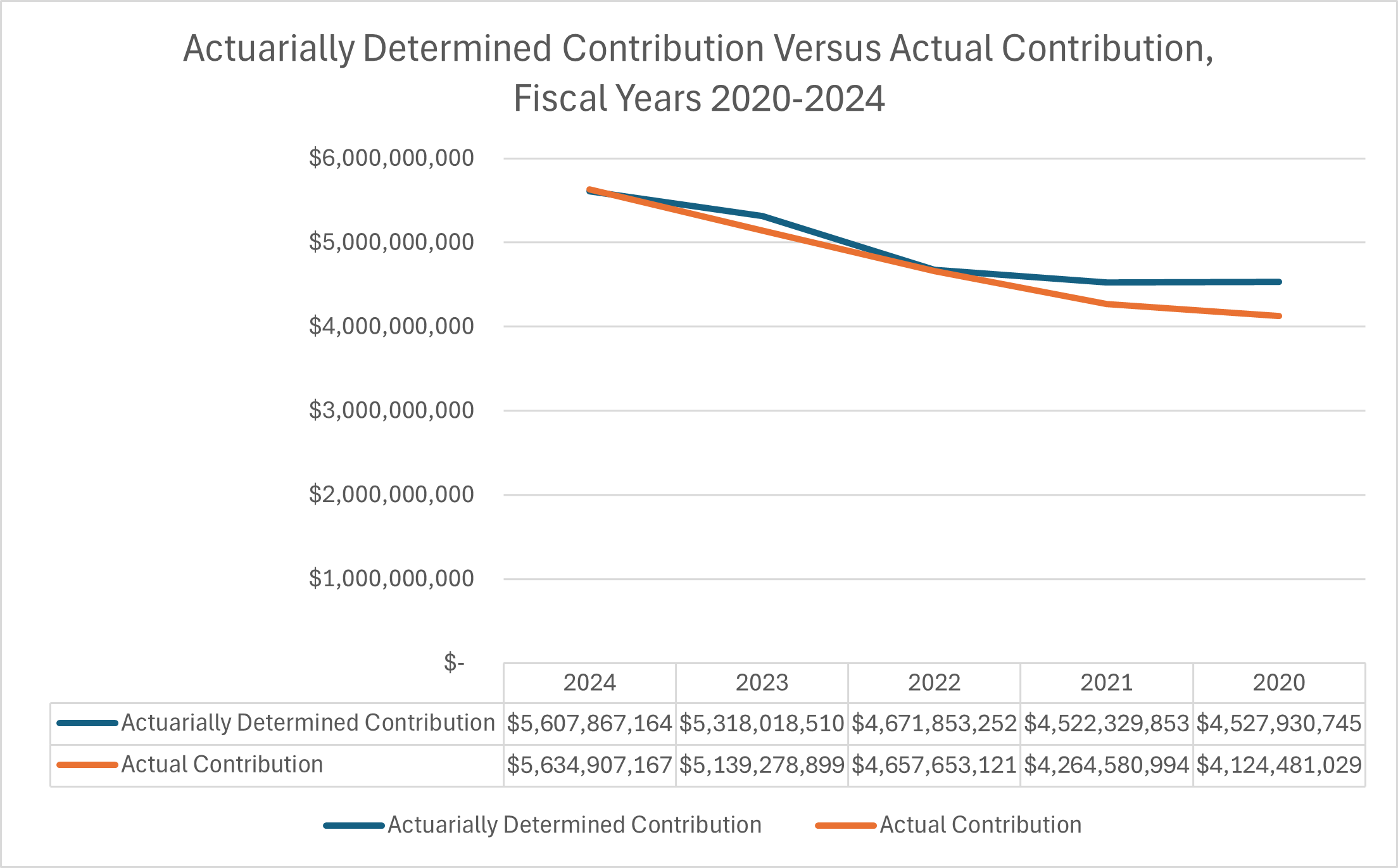

Actuarial Information

(As of August 31, 2024)ITEM AMOUNT Actuarial Accrued Liability (AAL) $257,543,259,438 Actuarial Value of Assets (AVA) $199,663,655,982 Unfunded Actuarial Accrued Liability (UAAL) $57,879,603,456 Funded Ratio (AVA/AAL) 77.8% Assumed Rate of Return 7.25% Valuation Payroll $59,658,161,321 UAAL as a percent of covered payroll 97.02% Amortization Period 28 Years Rate of Return - 1 Year 12.83% Rate of Return - 3 Years 3.01% Rate of Return - 10 Years 7.24% Actuarially Determined Contribution (ADC) 10.39% Total Contribution Rate 17.68% Actuarial Valuation Reports:

Actuarial Valuation Reports for prior years can be found by visiting the Teacher Retirement System of Texas website

Annual Reports

-

Annual Reports

Annual reports for prior years can be found by visiting the Financial Reports section on the Teacher Retirement System of Texas website.