Divisions

In the Spotlight

-

School safety spotlight: centralized vs. decentralized systems

Listen as we break down the pros and cons of safety management models and choosing the right one for your campus

-

All About Grants & More! workshop returns Feb. 17

Secure your spot to learn the latest in grant funding and AI tools

-

Fortis makes recovery education free for area districts

Tuition-free model helps students reclaim their futures

-

Work that adds up to more

Dual retirement programs, top ranking salaries just a few reasons people love working here!

-

Series opens dialogue on student well-being

Monthly virtual sessions equip educators with tools to support mental health in schools. Free registration and CE credits available.

-

Start the school year strong

Hear from after-school pros on building confidence, connection, and quality in youth programs

-

Learn about the perks of being a member of Choice Partners

Enhance your purchasing power! Our podcast explains the membership process and the significant benefits of joining Choice Partners

-

Learn all about grants on HCDE's new podcast series

Focus on Funding is your resource for grant essentials, perfect for anyone eager to learn about securing funding for their programs

HCDE In Motion

Latest News

-

‘Coach Kesha’ honored for two decades of sobriety and service to teens

Fortis Academy grad's story of transformation inspires students to believe change is possible

-

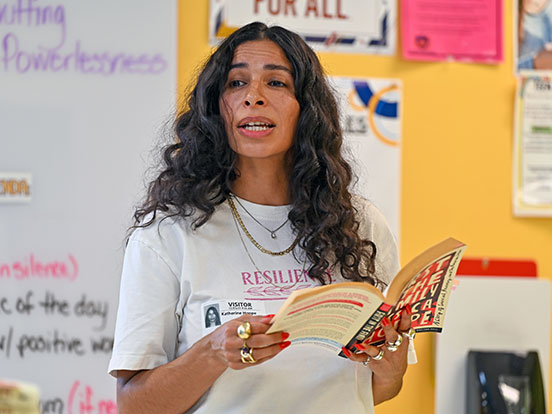

Nuestra Palabra connects Fortis students with acclaimed author

The Houston-based Latino literary group partnered with HCDE to host Jessica Hoppe, encouraging students to tell their stories and break stigmas around addiction

Upcoming Events & Workshops

-

Tuesday

-

Wednesday

-

Thursday

-

January 8, 2026

11:00 AM Let's Talk Mental Health Series: Elevating Mental Wellness

-

January 21, 2026

-

February 12, 2026

11:00 AM Let's Talk Mental Health Series: Eating Disorder Realities

-

February 17, 2026

8:00 AM - 3:30 PM All About Grants & More!

-

February 18, 2026

-

March 5, 2026

11:00 AM Let's Talk Mental Health Series: Supporting DID and Navigating Self-Harm Treatment

-

April 9, 2026

11:00 AM Let's Talk Mental Health Series: The Meaning of Semicolon Day

-

April 15, 2026

Harris County Department of Education

This notice concerns the 2025 property tax rates for Harris County Department of Education. This notice provides information about two tax rates used in adopting the current tax year's tax rate. The no-new-revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years. In most cases, the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The rates are given per $100 of property value.

| This year's no-new-revenue tax rate | $0.004725/$100 |

| This year's voter-approval tax rate | $0.005127/$100 |

Let's Get Social