Divisions

In the Spotlight

-

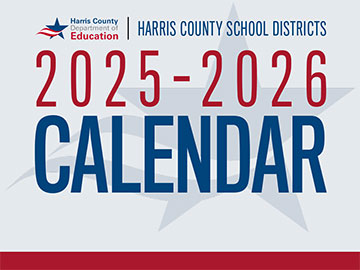

When does school start for area districts?

Coordinate holiday plans with your friends and family across the Houston area with our annual comprehensive calendar

-

Secure your spot for school safety summit on 8/1

Learn from experts, community members on how to create secure learning environments

-

HCDE celebrates graduation, job offers, teacher certification, and more

Watch video, see the photos, and read stories from end-of-year ceremonies

-

Work that adds up to more

Dual retirement programs, top ranking salaries just a few reasons people love working here!

-

Trauma doesn't take a summer break

Dr. Alicia McKinzy discusses the crucial role of school counselors, the impact of role stress, and more

-

See the list of winners from this year's Scholastic Art & Writing Awards

Check out photos from the ceremonies, download the program, and more!

-

Learn about the perks of being a member of Choice Partners

Enhance your purchasing power! Our podcast explains the membership process and the significant benefits of joining Choice Partners

-

Empowering youth for college success

Learn about the importance of teaching life skills to students to be better prepared for post-secondary education

-

Learn all about grants on HCDE's new podcast series

Focus on Funding is your resource for grant essentials, perfect for anyone eager to learn about securing funding for their programs

HCDE In Motion

Latest News

-

Harris County youth explore advocacy through art

Students visit local art studios and murals to learn about civic engagement, social issues

-

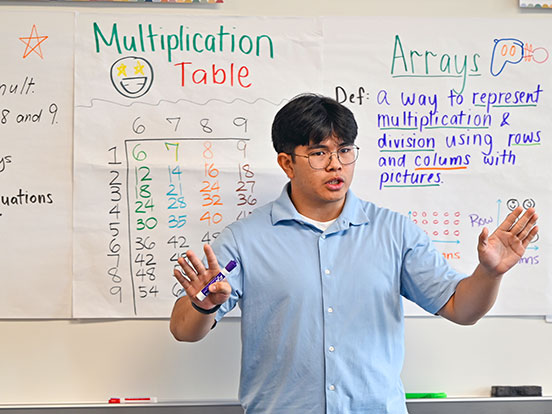

Aspiring educators showcase skills at summer intensive

After completing three-week program, teachers demonstrate knowledge in classroom management, instructional planning

Upcoming Events & Workshops

-

July 30, 2025

1:00 PM Board Meeting

-

August 1, 2025

8:30 AM - 3:30 PM Be the Impact: 2025 School Safety Summit

-

August 14, 2025

11:00 AM Let's Talk Mental Health Series: Holding Space for Grief

-

August 20, 2025

-

September 11, 2025

11:00 AM Let's Talk Mental Health Series: Strengthening Suicide Awareness

-

September 12, 2025

9:00 AM - 2:00 PM iPASS Small Business Academy

-

September 17, 2025

-

October 8, 2025

-

October 15, 2025

Harris County Department of Education

This notice concerns the 2024 property tax rates for Harris County Department of Education. This notice provides information about two tax rates used in adopting the current tax year's tax rate. The no-new-revenue tax rate would impose the same amount of taxes as last year if you compare properties taxed in both years. In most cases, the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The rates are given per $100 of property value.

| This year's no-new-revenue tax rate | $0.004800/$100 |

| This year's voter-approval tax rate | $0.005259/$100 |

Let's Get Social